Google Finance Stock Screener

With today’s dynamic financial markets, investors need to have access to sophisticated stock screening mechanisms to make effective investment decisions. Google Finance Stock Screener is an accessible yet underrated feature that allows traders, analysts, and investors to screen based on key financial indicators. Whether a day trader, long-term investor, or financial analyst, having the ability to use this feature will push your market analysis and portfolio management capabilities to the next level.

In this ultimate guide, we delve into the best strategies, premium filters, and pro tips to effectively utilize the Google Finance Screener. We’ll also cover how it stacks up against other leading stock screeners like Yahoo Finance, Finviz, and TradingView so you have the best in your arsenal.

What is Google Finance Stock Screener?

What is Google Finance Stock Screener?

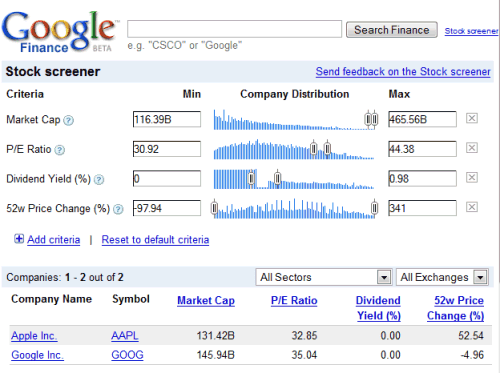

Google Finance Stock Screener is a no-cost investor utility with which to screen and filter by most financial metrics such as market cap, P/E ratio, dividend yield, and price change. While less sophisticated than some of its paid competitors, latest google finance currency converter, it boasts a simple interface with simple screening for individual investors and professionals alike.

Key Features of Google Finance Stock Screener:

Real-time stock information and history trends

Custom filters for technical and fundamental analysis

Multi comparison tools

Automated tracking with Google Sheets integration

Working with Google Finance Stock Screener Like a Pro

In order to make the most out of this tool, investors need to utilize advanced filtering techniques and support them with other types of best cryptocurrencies updates 2025 market analysis.

Step-by-Step Stock Screening Process:

Open the Google Finance Screener – Go to Google Finance and go to the “Screener” tab.

Set Your Filters – Employ major metrics such as:

Market top (Large-cap, Mid-cap, Small-cap)

P/E Ratio best technical analysis of financial markets(Overvalued and Undervalued stocks)

Dividend submit (Income stocks)

Dividend submit (Income stocks)

Price Performance (52-week high/low, % change)

Refine Your Search – Apply additional riddles such as sector, exchange, and liquidity to further filter results.

Export & Analyze Data best wealth management advisors – Export the filtered to study further in Excel or Google Sheets.

Best Stock Screening Techniques Using Google Finance

To outperform the market, investors need data-driven plan. Following are some proven tested screening strategies:

A. Value Investing Strategy

Filters: Low P/E (<15), Low P/B (<2), High Dividend submit (>3%)

Objective: Screen for economic with good fundamentals.

B. Growth fund Strategy

Filters: High profits growing (>10%), Low Debt-to-fairness best private equity investment (<0.5), High ROE (>15%)

Objective: Find companies with good pay growth prospects.

C. Dividend Stock Screening

Filters: Dividend submit >4%, Payout Ratio <70%, fast Dividend History

Objective: Build a passive income portfolio with chronic distributions.

D. Momentum Trading Strategy

Filters: 52-week high stocks, High parallel Volume (>1.5x), RSI (30-70)

Objective: Capture short-term current movements for swing trading.

Advanced Tips for Pro Investors

For an edge, try these pro-level tips:

A. Blend with Google Sheets for Automated Trace

Utilize the GOOGLE FINANCE () formula to bring late details into spreadsheets.

Example: =GOOGLEFINANCE(“AAPL”, “price”), latest google finance portfolio tracker go back to the current goods price of Apple.

B. Use part & Industry Comparisons

Compare P/E multiples, growth rates, and sides between industries to find outliers.

C. Track Insider Transactions & Institutional Ownership

Although Google Finance does not give this, use SEC filings (Edgar) or Yahoo Finance as a supplement.

D. Set Price Alerts

Use the portfolio tracker on best google finance dividend stocks to create price movement alerts.

Limitations of Google Finance Stock Screener

Limitations of Google Finance Stock Screener

Although kind, the tool has some limitations:

Limited technical mark (No MACD, Bollinger Bands, RSI)

No pre-market/after-hours certainty

Fewer customization choice than Finviz or TradingView

A combination with other systems for agile traders is recommended.

Conclusion

Is Google Finance Stock Screener Worth Using?

Google Finance Stock Screener is a good free fundamental screen tool for long-term investors and newbies. But serious traders need to trimming it with Finviz, TradingView, or Bloomberg Terminal for advanced survey.

By using the approaches outlined here—value investing, bonus screening, and momentum trading—you can add depth to your picking action. Furthermore, best business loan interest rates 2025 incorporating Google Sheets for automated trace can be time-saving and efficient as well.

Compared to competitors like Finviz, Yahoo Finance, and TradingView, Google Finance is good enough on the fundamental screening side but not quite so on the technical analysis side. Finviz offers superior charting and more advanced screening features in its paid version. TradingView has the best-of-breed technicals and also has the social sentiment features. Yahoo Finance is in between with solid fundamental information and some basic technical features. The intelligent investor will often employ Google Finance as an initial screener best sustainable finance initiatives before utilizing these other resources to drill deeper, possessing integrated workflow research that takes the best from each resource.

To make the best use of the Google Finance Screener, authorities advise incorporating systematic screening methodologies for precise investment contexts. A disciplined approach would include weekly sweeps of new ideas, in addition to automated notification of unusual price action in monitored stocks.

The ease of use of the site is a bonus when used as part of a holistic investment process, allowing instant taking up of potential opportunities latest AI in financial services worthy of further analysis. There is no one device that can ever guarantee investment profit, but mastering the Google Finance Stock Screener can be a definite benefit to marketplaces today by allowing investors to scan thousands of stocks quickly to determine which best fits what they are searching for.